Today marks the end of February and with that, the countdown for filing the tax returns has begun. You must be scratching your head, thinking viciously about how to tackle the soaring liabilities of tax, and how to prevent your wealth from getting hurt by the tax authorities every year. Well, worry not, as this article has been written for solving all your tax related problems and enable you to live without fretting about your tax burdens. The one stop solution for this evil problem of your life is simply making an investment in Mirae Tax Saver Fund , a solid mutual fund belonging to the ELSS category, using MySIPonline’s exceptional online financial services which will not only work like a poultice to your bruised wealth, but will also protect it from any further damage. Let’s find out more about this fund and how does it act as a shield to your hard-earned money.

ELSS Funds - Knowing the Category

Equity Linked Saving Schemes, better known by their abbreviation ELSS, are a tax saving investment avenue which are considered as the best option amongst several other tax-saving options available, since they bear the least lock-in period than any other alternative. Apart from saving you big bucks on your tax liabilities, these funds also strengthen your current financial position, thus allowing opportunities to grow exponentially. Since investment in these schemes qualify for a deduction up to Rs. 1,50,000 from your total taxable income under Section 80C of the Income Tax Act, 1961, you are thus able to save a might Rs. 46,350 on your tax liabilities.

Mirae Tax Saver Fund - An Overview

Mirae Asset Tax Saver Fund is a brand new mutual fund scheme offered by one of the highly regarded asset management companies in the world, Mirae Asset. Launched at the brim of 2015, this fund has since taken the command of creating a healthy investment environment by emitting A-grade performances and saving the precious gold of the investors from getting ransacked by letting them avail the benefit of Section 80C, and also helping them save the capital gain liabilities arising on the redemption owing to the inherited lock-in period of 3 years.

The Fundamentals

Before investing in any mutual fund, it is important to take a note of the prevailing per unit value as well as the size of the corpus it manages, so as to determine whether a fund is worthy of buying. Let’s have a look at the numbers secured by Mirae Asset Tax Saver Fund (Growth): -

- Mirae Asset Tax Saver Fund NAV witnessed a drop to the tune of 0.51% from its previously recorded value and stood at Rs. 16.454 as on 27th February, 2018.

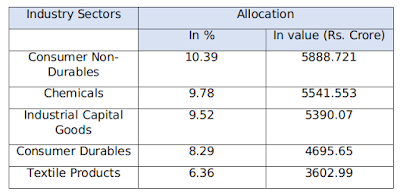

- The fund manages a huge corpus that secured the mark of Rs. 857 crore as on 31st January, 2018, out of which the majority of the funds (61.63%) are stuffed in the stocks of giant companies.

The Returns

Considering the fact that this fund is only two years old, it has still been able to put a leash on the market vibrations as can be seen from the remarkable returns that it has fetched since its inception, a brief account of which is given below: -

Though there is a plethora of tax-saving investment options available out there, not all reciprocate in the same fashion as Mirae Tax Saver Fund. So, stop cracking your head by spending hours for searching for that perfect scheme, as with MySIPonline you can get done with the entire investment process in the best ELSS mutual fund schemes in less than 10 minutes.