With more than 2000 primary schemes ready to serve to the investors, the mutual fund industry is growing big every minute, as we speak. Now, it might intrigue you that this industry is expanding with full force which ultimately means a goldmine of opportunities, but unfortunately, this is not the case, not with every scheme that you choose. Thus, “Choosing the best and leaving the rest” shall be your motto if you are willing to join the league of smart investors, and you can get a jump start by investing in Reliance Small Cap Fund through SIP, using the impeccable online services of MySIPonline. The process is simple, safe and hassle-free, where you don’t need to suffer the pain of paper formalities. And, where you’ll find superb tips on how to make a wise financial plan with the help of daily blogs posted on this website. But before you become all perky and immediately jump on the page of MySIPonline, let’s pay some attention to this beautiful write-up that has been written with a lot of hard work and research. So, brace yourself as we are going to unearth some more information on Reliance Small Cap, and see whether it’s worthy enough to catch your attention.

Reliance Small Cap Fund (Growth) – The Inside Story

Whether you are someone who’s always tuned in to the latest market news, or someone who occasionally pays attention when he’s got nothing better to do with his time, you must have heard about Reliance Mutual Fund since it’s one of the biggest and most trusted brands in the Indian money market. Thus, there’s a strong goodwill and sense of faith associated with every product that this brand releases and out of which, Reliance SmallCap is one of the most favourite releases of this AMC.

It is a customer-centric scheme which is engineered to perform well even in the most turbulent conditions in the market, and is carefully handled by some of the brightest minds in the financial market game. With the top holders of this fund being some of the most successful companies across different sectors further makes it a promising investment course. Further, the fund is devised in a way that it primarily works towards the direction of generating abundant capital in the long run for the investors by investing in equity and related instruments of the small companies, and generating consistent returns through a reasonable allocation of funds in debt and money market instruments.

Reliance Small Cap Fund – The Essential Data Chart

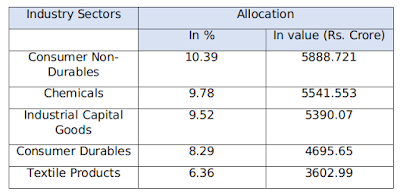

As discussed earlier, this fund is backed by holdings of some of the top players across different industries, a brief account of which has been given below: -

As evident from the above data chart, Reliance Small Cap Growth Fund Investment has a fair allocation of assets towards some of the good performing industries in the current scenario. Thus, if the stocks comprised in a fund belong to strong industry sectors, it is obvious that the fund will reap good returns for the investors and they will not have to undergo the trouble of cash crunch during the market correction.

Whether you are an old player in the market or have just started learning the tricks, for the moment, it doesn’t matter, as the market is a menacing maze of corridors and one wrong move can get you trapped and it isn’t easy to find your way out to home. Hence, to play safe, it is strongly recommended that you stick to a reliable investment plan such as Reliance Small Cap Fund, where your money will breathe safely. Check out MySIPonline today, in order to unravel the nitty-gritty of this scheme.

No comments:

Post a Comment